GMAC Works

Protect More, Pay Less - when has 'good enough' ever been 'good enough'? Stop worrying, start protecting your assets.

True security isn’t about avoiding risks; it’s about knowing you have a shield when life’s storms arrive.

Let our team shine a spotlight on the lowest premiums and the highest protection available to protect you and your business. We help you focus on what truly matters by making sure you are covered no matter what life throws your way.

Business Class Codes We Specialize in:

Roofing

PLumbing

Wiring / Electrical / Cable

Solar

Printing

LOgistics

Carpentry / woodworking

Sheetrock / Drywall

Janitorial

Storage / Warehouse

Auto Service

Medical

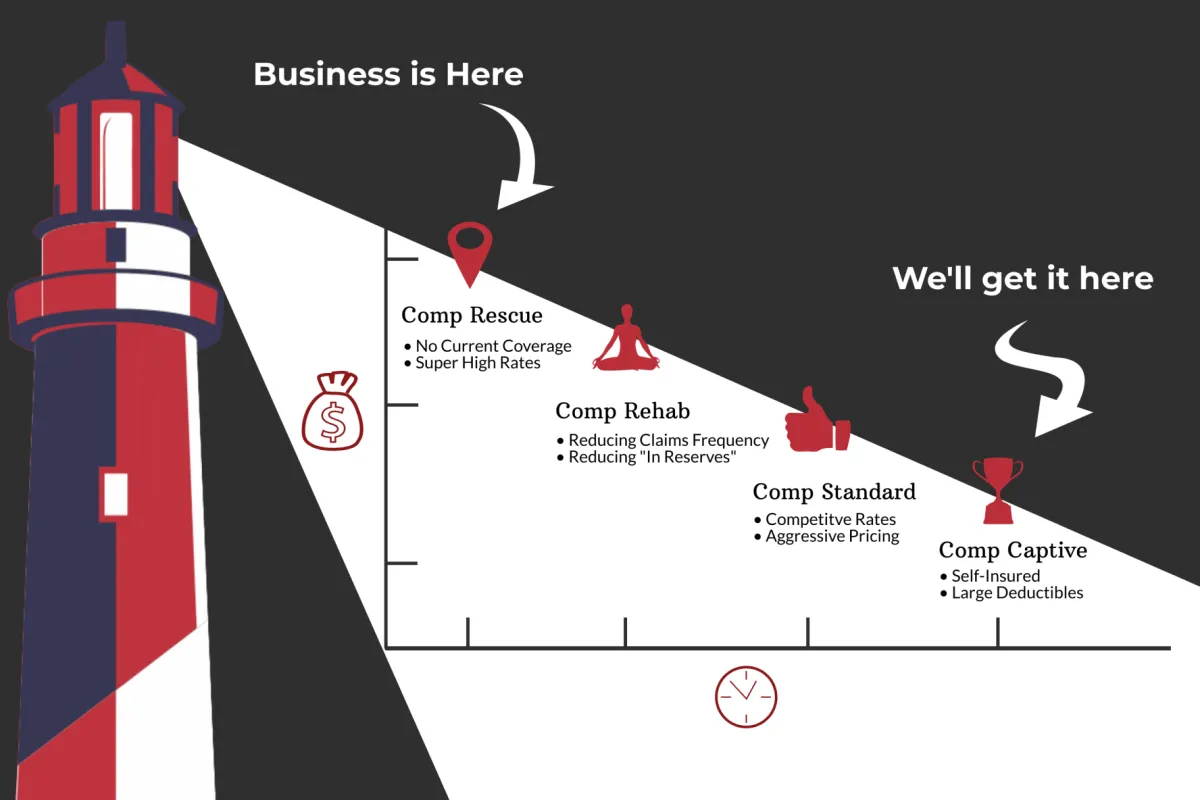

Where Is Your Business?

If you are struggling to get the coverage you need to protect your business at a rate you can afford to pay without making operating costs prohibitive to actually operating, click below to get a free quote put together for you. It's less about what you have to lose and more about the gains...more money.

Our Offerings

General Liability Insurance

General Liability Insurance provides crucial protection for small businesses by covering legal expenses and damages in case of third-party claims related to property damage, bodily injury, or personal injury caused by business operations.

You can’t control what people do — or sue over. But you can control how prepared you are. General liability insurance doesn’t mean you’re planning for failure. It means you’re planning to stay in business, no matter what curveballs come your way.

Let GMAC Works help you protect your business the smart way — without the runaround, the fine print traps, or the overpriced nonsense.

Property and Casualty Insurance (P&C

“Property and casualty” sounds like a scary legal term, but don’t worry — it’s just a fancy way to say: “We’ll help you fix your stuff and protect you if someone sues.”

Property Insurance covers:

Buildings you own or leaseTools, equipment, inventory, and furnitureLost income if your property is damaged and you can’t operateFire, theft, storms, vandalism — you know, all the drama

Casualty Insurance covers:

Your legal responsibility if someone gets hurt or something gets damaged because of your business (a.k.a. liability)Slip-and-fall lawsuits, customer injuries, or damage your business causes to other people’s property

Together, they’re like peanut butter and jelly — better as a pair.

Commercial Auto Insurance

Commercial auto insurance covers the vehicles your business owns, leases, or uses for work. It protects you from the financial fallout of accidents, injuries, property damage, and lawsuits involving business vehicles.Whether you’re hauling supplies, delivering goods, transporting clients, or just heading to job sites, if you’re using a vehicle for business purposes, your personal auto insurance probably won’t cover you. (Spoiler: They’ll laugh you off the phone.) That’s where commercial auto comes in.

Professional Liability Insurance

Business Interruption Insurance provides financial protection to businesses during unforeseen events that disrupt their operations, covering lost income and expenses to help them recover and continue operating smoothly.

Testimonials

John doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

John doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

John doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

Frequently Asked Questions

What types of businesses do you cover?

At GMAC Works, we provide tailored insurance solutions for a wide range of industries, with a particular focus on businesses that operate in high-risk sectors.

Our coverage includes, but is not limited to:

• Construction and Contractors

• Manufacturing and Industrial Services

• Healthcare and Medical Practices

• Transportation and Logistics

• Hospitality and Entertainment

• Retail and Wholesale Operations

• Agriculture and Farming

• Energy and Utility Services

• Technology and IT Firms

• Nonprofits and Community Organizations

We specialize in creating customized insurance packages that address the unique challenges these industries face, ensuring comprehensive protection and peace of mind. If your business doesn’t fall into one of these categories, reach out — we’re dedicated to finding solutions that meet your specific needs.

Do you offer customizable insurance packages?

Yes, at GMAC Works, we specialize in creating customizable insurance packages tailored to meet the unique needs of your business. We understand that no two businesses are alike, especially those operating in high-risk industries. Our flexible insurance solutions allow you to combine various coverage types to ensure comprehensive protection without paying for unnecessary extras. Whether you need protection for property, liability, employees, or specialized risks, we work with you to build a customized plan that aligns with your industry, budget, and risk profile. Our goal is to provide you with the right coverage — nothing more, nothing less.

What is the process for filing a claim?

At GMAC Works, we’ve designed our claims process to be straightforward and stress-free.

Here’s how it works:

1. Report the Incident: As soon as an incident occurs, contact our claims team immediately. You can reach us by phone, email, or through our online portal. Providing prompt notice helps us initiate your claim quickly.

2. Gather Documentation: Collect all relevant details about the incident. This may include photos, witness statements, police reports (if applicable), and any other supporting documentation.

3. Submit Your Claim: Our team will guide you through the submission process, ensuring all necessary information is included to expedite your claim.

4. Claim Review: Once submitted, our claims specialists will review the details, assess the situation, and determine the best course of action. We’ll keep you informed throughout the process.

5. Resolution and Payment: After review and approval, we’ll work to resolve your claim efficiently, ensuring you receive the appropriate payout or assistance as quickly as possible.

Our dedicated team is here to support you every step of the way, ensuring the claims process is smooth, transparent, and tailored to your needs. If you have questions or need guidance, we’re always available to help.

How can I determine the right coverage for my business?

Determining the right coverage for your business starts with understanding your unique risks and operational needs.

At GMAC Works, we simplify this process through a personalized approach:

1. Risk Assessment: Our experts will assess your industry, business size, and potential exposures to identify key areas that need protection.

2. Coverage Consultation: We’ll walk you through available options, including general liability, workers’ compensation, professional liability, property insurance, and more — tailoring each policy to suit your business.

3. Customized Solutions: We specialize in building flexible insurance packages that align with your budget while providing comprehensive protection.

4. Ongoing Support: As your business evolves, we continuously evaluate your coverage to ensure you’re protected against emerging risks.

By working with GMAC Works, you gain access to expert guidance and tailored solutions that safeguard your business from unexpected challenges. Reach out to our team today for a personalized consultation!

What factors influence insurance premiums?

Several key factors influence your business insurance premiums. At GMAC Works, we assess these factors to ensure you receive fair and accurate pricing for your coverage.

Key considerations include:

1. Industry and Risk Profile: High-risk industries like construction, manufacturing, and transportation often have higher premiums due to increased exposure to accidents or liability.

2. Business Size and Revenue: Larger businesses or those with higher revenue may face increased premiums due to greater operational complexity and potential liabilities.

3. Number of Employees: More employees typically increase workers’ compensation costs and liability risks.

4. Coverage Limits and Deductibles: Higher coverage limits provide more protection but may raise premiums, while choosing a higher deductible can reduce your premium.

5. Claims History: A history of frequent or costly claims may result in higher premiums, while a clean record can lower costs.

6. Location: Businesses in areas prone to natural disasters, theft, or other risks may face higher premiums.

7. Type of Services or Products: Certain services or products, especially those with safety concerns or high liability risks, can increase premiums.

8. Safety and Risk Management Practices: Implementing strong safety protocols, employee training programs, and risk management strategies can reduce your premiums.

At GMAC Works, we help you identify strategies to mitigate risks and manage costs effectively. Our goal is to provide you with comprehensive coverage that aligns with your budget and business needs.

Do you provide ongoing support and policy updates?

Yes, at GMAC Works, we provide ongoing support and regular policy updates to ensure your coverage stays aligned with your evolving business needs. Our commitment doesn’t end once your policy is in place — we’re here to support you every step of the way.

Our ongoing support includes:

✅ Annual Policy Reviews: We assess your coverage each year to ensure it reflects any changes in your business operations, employee count, or risk exposure.

✅ Risk Management Guidance: We help you identify potential risks and recommend proactive strategies to improve safety and minimize claims.

✅ Claims Assistance: If you experience an incident, our dedicated team will guide you through the claims process to ensure a smooth and timely resolution.

✅ Regulatory Updates: We stay informed on industry regulations and compliance changes, so your coverage meets legal requirements.

✅ Flexible Adjustments: Whether you’re expanding your services, adding new employees, or upgrading equipment, we’ll help you adjust your policy to keep you fully protected.

At GMAC Works, our goal is to build a lasting partnership that gives you peace of mind as your business grows and evolves.